Would You Let $80 a Month Hold You Back from Buying a Home?

Keeping Current Matters November 15, 2025

Keeping Current Matters November 15, 2025

A lot of buyers are stuck in “wait and see” mode right now. They’re watching rates hover a little above 6% and thinking, I’ll buy once they hit the 5s. Because who doesn’t want a better rate?

But here’s the thing: that 5.99% number might not save you as much as you think.

Affordability is still a challenge. There’s no question about that. But the market has given savvy buyers a head start. Mortgage rates have already come down over the past few months. And the drop we’ve seen saves you more than you’d think.

Let's put some real numbers to it. Rates peaked for the year in May when they inched above 7%. But since then, they’ve been slowly declining. Now, they’re sitting in the low 6s. And while that may not sound like a big deal, that change translates to real dollars.

According to data coming out of Redfin, the typical monthly payment on a $400,000 home is already down almost $400 since May.

That means if you’re buying a home now, you're saving hundreds of dollars every month compared to what you would have been able to get earlier this spring. That’s real money that makes a real difference for buyers who paused their plans because they thought homeownership was out of reach.

And while it may be tempting to wait even longer to see bigger savings, that’s a gamble that could cost you. Here’s why.

For starters, most experts say mortgage rates are likely to stay pretty much where we are today throughout 2026. So, there’s no guarantee we’ll see a rate much lower than what we have now. Only one expert forecaster is saying rates could fall into the upper 5s next year (see graph below):

And even if rates do dip below 6%, the extra savings you’re holding out for won’t move the needle as much as you might expect.

And even if rates do dip below 6%, the extra savings you’re holding out for won’t move the needle as much as you might expect.

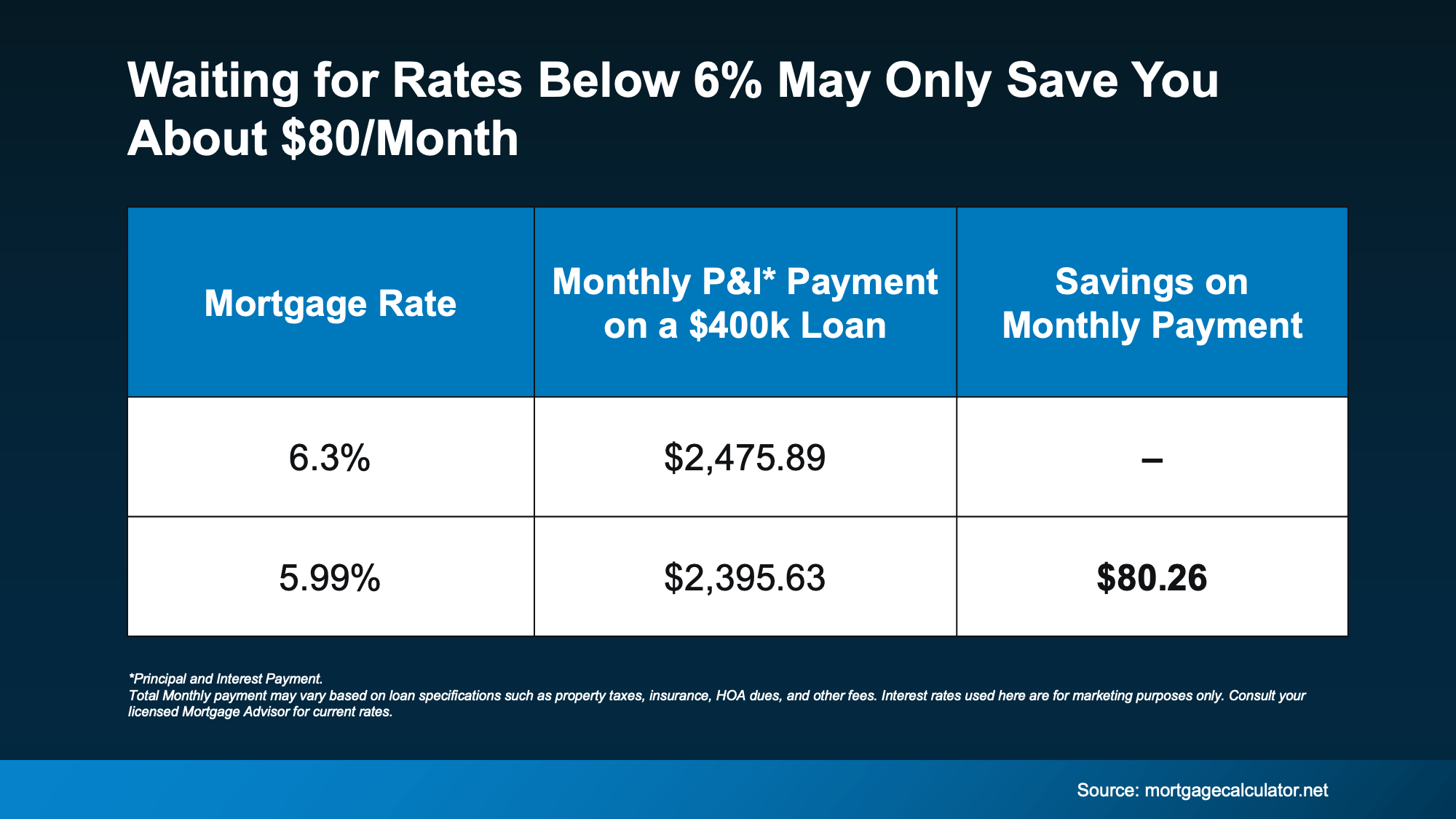

Let’s break it down. If rates come down to 5.99% from where they've been lately that’s a difference of only about $80 a month on an average priced home – give or take a bit based on your price point and the rate your lender quotes you (see chart below):

Eighty dollars. That’s it. And for the typical family, that’s about one dinner out (or one dinner in, if you have it delivered). That’s not enough to change the game for most buyers. But the savings of nearly $400 we already have compared to when you paused your search in the spring? That might be.

Eighty dollars. That’s it. And for the typical family, that’s about one dinner out (or one dinner in, if you have it delivered). That’s not enough to change the game for most buyers. But the savings of nearly $400 we already have compared to when you paused your search in the spring? That might be.

So, the question to ask yourself is this:

Is an extra $80 savings really worth the wait?

Because while you’re holding out for that small dip, the bigger opportunity might be slipping away.

Right now, you have more homes to choose from, sellers who are ready to negotiate to get a deal done, and fewer buyers to compete with. But once rates fall below 6%, buyer mindsets will shift and all of that will change.

The National Association of Realtors (NAR) reports that if rates hit 6%, about 5.5 million more households will be able to afford the median-priced home. Even if only a small fraction of them decide to buy, that could mean hundreds of thousands of buyers getting back into the market.

That creates more competition for you, which would push home prices even higher – maybe high enough to cancel out the extra savings you waited for.

So, if you’re waiting for rates below 6%, just keep in mind... that extra $80 may not be worth it in the grand scheme of things.

You don’t have to wait for 5.99%. You have the chance to move (and save) right now. So, ask yourself: Would you let $80 hold you back from buying a home?

If you find a home you love and the math makes sense, getting ahead may be the best strategy. Let’s run your numbers so you can see what you’re working with in our market.

Stay up to date on the latest real estate trends.

You may have heard homeowners today have a lot of equity built up. But what does that really mean? Let’s break it down. Because your equity isn’t just a number, it’s … Read more

For a growing number of homeowners, retirement isn’t some distant idea anymore. It’s starting to feel very real.

When homes are expensive and competition is tight, it’s easy to assume giant companies are scooping everything up behind the scenes.

One of the biggest homebuying advantages you can give yourself today is surprisingly simple: a flexible wish list.

For expert real estate services, reach out to Mike Doyle. Whether you're buying, selling, or renting, navigate the process with confidence. Contact him today to ensure a smooth and informed real estate journey.