Are Big Investors Really Buying Up All the Homes? Here’s the Truth.

Mike Doyle January 17, 2026

Mike Doyle January 17, 2026

It’s hard to scroll online lately without seeing some version of this claim:

“Big investors are buying up all the homes.”

And honestly, if you’re a homebuyer who’s lost out on a few offers, that idea probably sounds believable. When homes are expensive and competition is tight, it’s easy to assume giant companies are scooping everything up behind the scenes.

But here’s the thing: what people assume is happening and what the data actually shows aren’t always the same.

Let’s look at what’s really happening with large institutional investors in today’s housing market – because the numbers tell a much different story than the headlines.

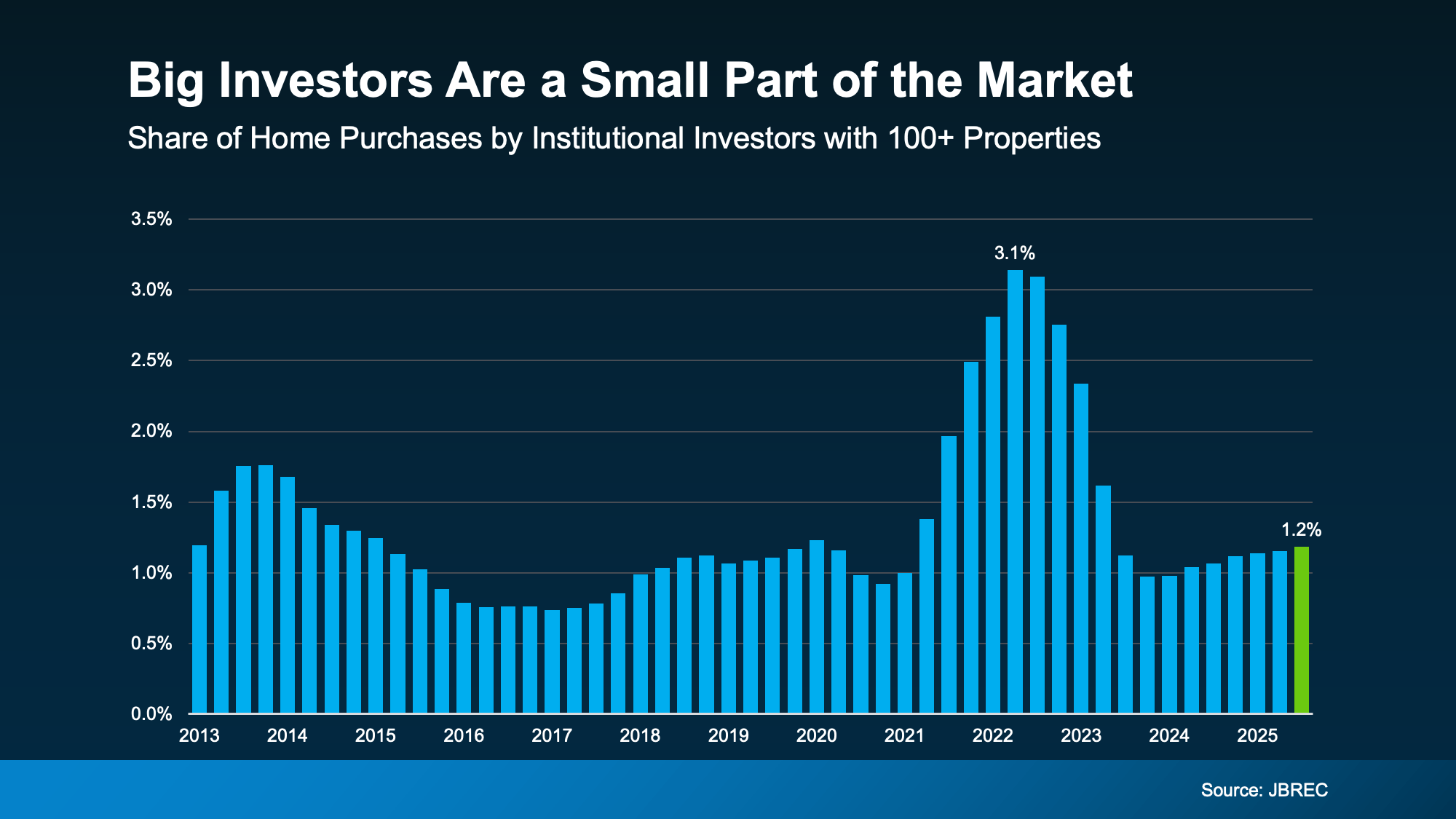

Let’s start with the most important stat. According to John Burns Research & Consulting (JBREC), large institutional investors – those that own 100 or more homes – made up just 1.2% of all home purchases in Q3 of 2025 (see graph below):

That’s it. Out of every 100 homes sold, only about 1 went to a large institutional investor.

That’s it. Out of every 100 homes sold, only about 1 went to a large institutional investor.

And here’s an important point that often gets missed: that level of investor activity is very much in line with historical norms. It’s not unusually high, and it’s actually well below the recent peak of 3.1% back in 2022 – which itself was still a small share of the overall market.

So, while it can feel like big investors are everywhere, nationally, they’re a very small part of overall home sales.

There are two main reasons this topic gets so much attention:

Yes, big investors exist. Yes, they buy homes. But nationally, they’re responsible for a very small share of total purchases – far smaller than most people assume.

The bigger challenges around affordability have much more to do with supply, demand, and years of underbuilding than with large institutions competing against everyday buyers.

That’s why it’s so important to separate noise from reality, especially if you’re trying to decide if now is the right time to move.

If you want to talk through what investor activity actually looks like in our local market, and how it impacts your options (or doesn’t), let’s connect.

Sometimes a little context makes all the difference.

Stay up to date on the latest real estate trends.

Let’s be clear: selling your house is absolutely possible right now. According to the National Association of Realtors (NAR), roughly 11k homes sell every day in this … Read more

You may have heard homeowners today have a lot of equity built up. But what does that really mean? Let’s break it down. Because your equity isn’t just a number, it’s … Read more

For a growing number of homeowners, retirement isn’t some distant idea anymore. It’s starting to feel very real.

When homes are expensive and competition is tight, it’s easy to assume giant companies are scooping everything up behind the scenes.

For expert real estate services, reach out to Mike Doyle. Whether you're buying, selling, or renting, navigate the process with confidence. Contact him today to ensure a smooth and informed real estate journey.