What caused one of the largest commercial real estate bubbles since the 2008 financial crisis? In a nutshell, Gajavelli's company had adjustable interest rate loans with balloon payments. Inflation increased expenses, but rental revenues could not make up the difference. As a result, invoices got past due, resulting in the foreclosure of these properties. Thousands of individual investors searching for passive income (without being a landlord) are suddenly out of luck.

Should Individual Investors Be Worried About a Potential Housing Bust?

Syndicators raised a whopping $115 billion between 2020 and 2022. In addition, according to Financial Samurai, approximately 300,000 investors participated in syndications in 2021.

As much as I would like to believe that this is a one-time occurrence, I feel that it could have a ripple impact on the industry.8

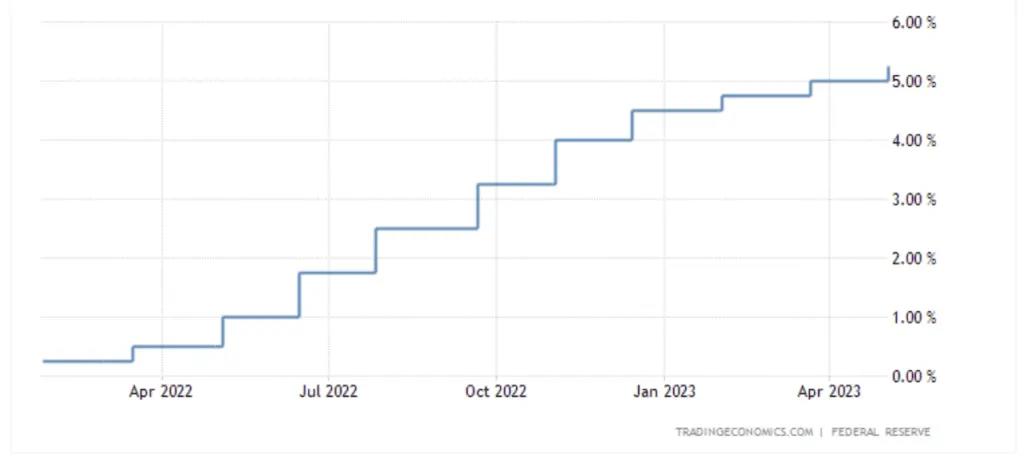

Assuming that other major syndicators have variable-rate loans (with no interest rate cap), they will face financial pressure from higher payments. This is due to the Federal Reserve raising interest rates rapidly for the tenth time since March 2022. Syndicators are unlikely to be able to avoid renewing at higher rates in the foreseeable future.

Aside from that, there are a number of reasons that can cause things to go wrong. Poor property management, underestimating operating expenses, and a rental income shortfall to keep them afloat, for example, could cause the business model to deteriorate. It won't be as severe as the 2008 housing market meltdown, but I wouldn't be surprised if a few syndicators fail this year.

What Should Be Done To Protect Small Investors?

All of this, in my opinion, could have been avoided if the government—at both the state and federal levels—had taken greater responsibility to protect private investors.

I'll give Congress the benefit of the doubt and assume that when they passed the JOBS Act in 2012, they had good intentions in allowing syndicators to offer real estate investment possibilities online. This made investing more accessible to American families. On the surface, this seemed like a fantastic concept. In reality, systemic flaws have resulted in this disastrous conclusion.

It is a complex issue that will not be resolved overnight. All stakeholders involved, however, must be held accountable. For one thing, I believe that syndicators should accept responsibility by being open and honest with their investors about their financial performance. Regular reporting to all of their investors would help to create trust between the two sides.

Furthermore, individual investors should be given broader legal protection. If I were in their situation, I'd want to know how my investment is performing and not be caught off guard when it's too late.

Also, shouldn't syndicators have a stake in the game? Shouldn't they do the same if they're asking investors to put up significant sums of money?

These victims are industrious Americans attempting to realize their "American dream," and thousands of lives (perhaps more) are now in shambles as a result of this defective system. It's a difficult lesson for these little investors, who must rebuild their financial nest egg.

How Can You Protect Yourself As An Individual Investor?

Here are a few methods to be proactive and protect yourself if you wish to become a passive investor with a syndicator.

-

Network with other investors to discover a reliable real estate syndicator with a proven track record. The BiggerPockets forum is an excellent place to begin.

-

Investigate and vet the company to ensure its dependability.

-

Before you hand out big sums of money, determine your risk tolerance. There are always hazards associated with real estate.

-

Don't put all your eggs in one basket, or you can find yourself holding the bag.

-

If something appears to be too good to be true, it most likely is. Don't succumb to FOMO. A business should not overpromise or guarantee unrealistic results in a short period of time.

With these pointers in mind, you should be able to make informed selections regarding whether real estate investments are right for you. Again, we have no idea what the consequences of this event will be. It might be possible to isolate it. But, if foreclosures can happen to one syndicator (and unless others are more diligent), I believe there will be more on the horizon.